- Home

- FATCA and CRS

FATCA and CRS

Stay one step ahead: CRS and FATCA overview and regulations

The tax information reporting landscape has changed substantially in recent years and is set to become even more complex in the future.

Evolving international tax regulations are challenging organisations around the world to implement new procedures in order to maintain compliancy. Thomson Reuters ONESOURCE™ offers an integrated solution that combines key requirements for both the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) compliance.

Understanding FATCA and CRS Compliance

FATCA and CRS have similar characteristics on the surface, but there are underlying differences that make universal compliance complex and challenging.

FATCA

Introduced by the Internal Revenue Service (IRS), FATCA prevents US taxpayers who hold financial assets in non-US financial institutions and offshore accounts from avoiding taxation on their income and assets. Foreign financial institutions agree to report on these US account holders or face 30% withholding on all US income.

CRS

CRS is a global reporting standard for the automatic exchange of information (AEOI) set forth by the Organization for Economic Cooperation and Development (OECD). More than 96 countries share information on residents’ assets and incomes in accordance with reporting standards. CRS is more extensive than FATCA, and thus requires a unified, cross-team effort to ensure readiness and compliance.

Documentation

A major component of FATCA and CRS requires financial institutions to solicit and validate client tax documentation. Thomson Reuters ONESOURCE™ AEOI Documentation helps you gather client information now, ensuring a more cost effective, efficient, and streamlined reporting process.

Reporting

Global compliance reporting is rapidly becoming a new challenge for financial institutions. Thomson Reuters ONESOURCE™ AEOI Reporting offers an integrated solution that automates FATCA and CRS reporting to simplify your tax reporting process.

Video

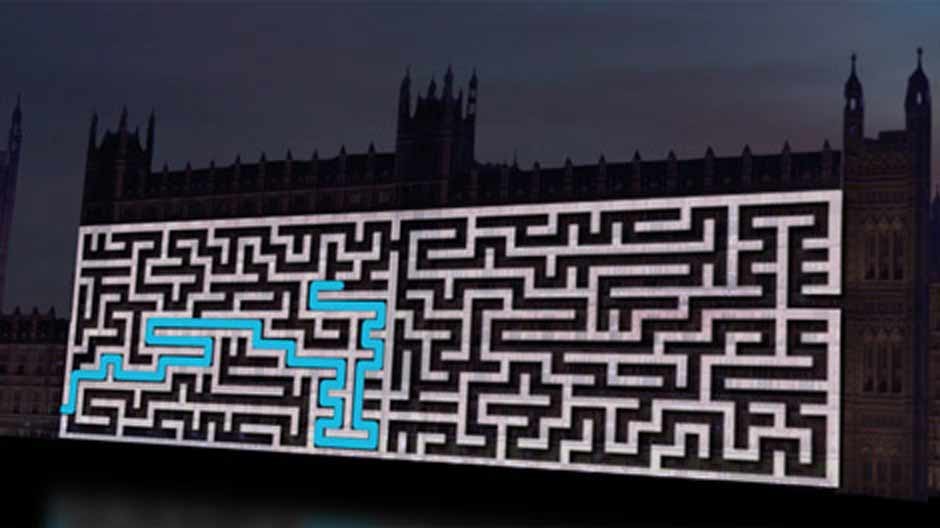

FATCA & CRS: Navigating the Unknown

The need for tax transparency has accelerated in recent years. Thomson Reuters provides solutions in an ever changing climate.